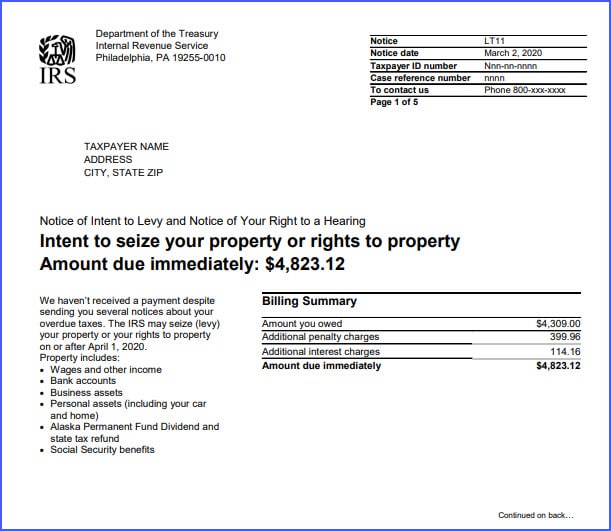

You Received an IRS LT11, Final Notice of Intent to Levy. What’s Next?

Receiving an LT11 (or a Letter 1058) Final Notice of Intent to Levy from the IRS can be overwhelming, especially when it arrives unexpectedly. This notice is a critical warning that the IRS intends to levy your assets if the outstanding tax liability is not addressed promptly. A levy is the IRS’s legal authority to…