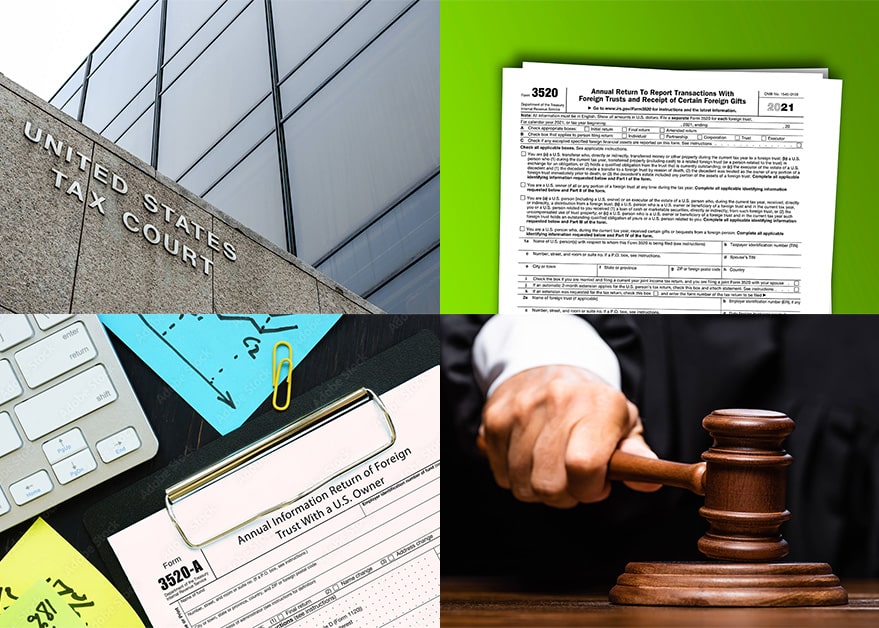

Tax Court Rejects Excessive Fines Clause Argument and Upholds $11 Million Form 3520 and Form 3520-A Penalties

The Mukhi v Commissioner[1] case is another example of just how severe the penalties are for failing to report certain foreign financial activity timely; in this case, it was the failure to report foreign trusts, related trust activity, and ownership of a foreign corporation on Form 3520, Form 3520-A, and Form 5471 in a timely…