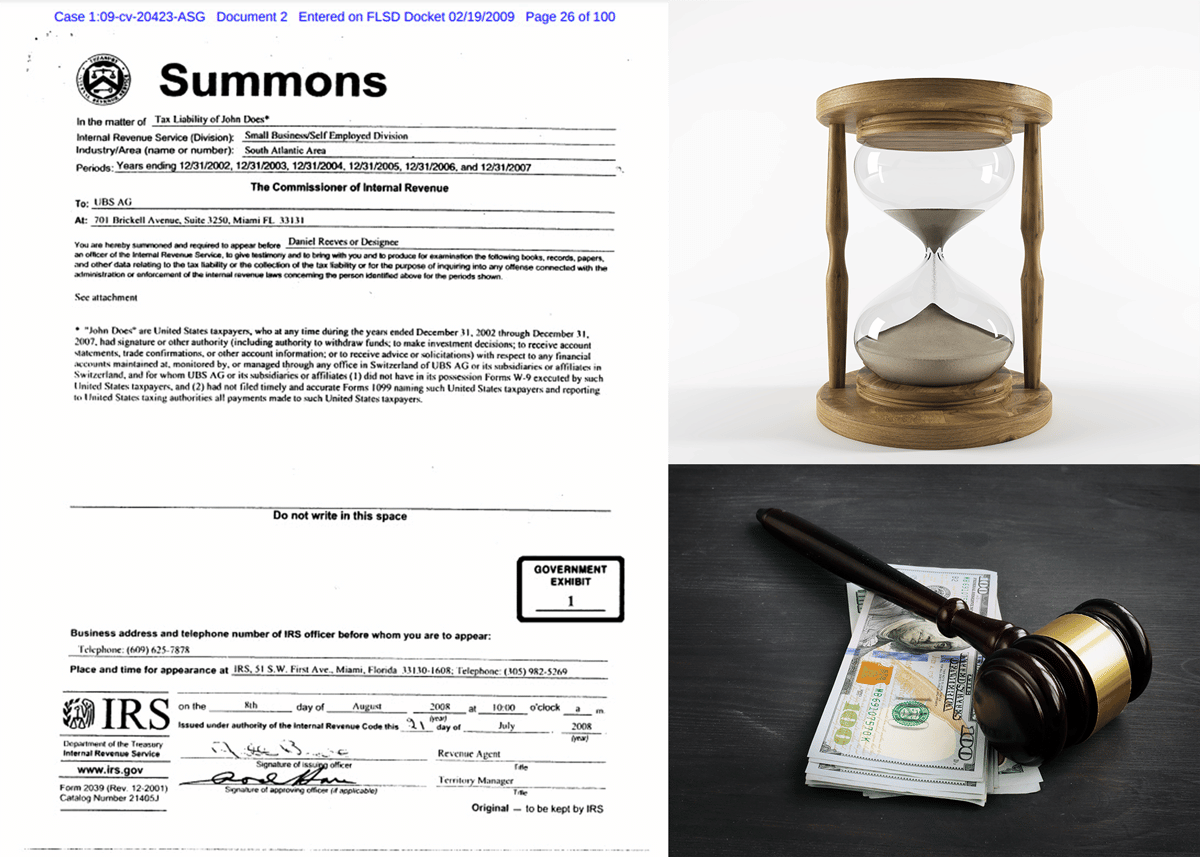

D.C. Circuit Upholds Tax Court Decision That John Doe Summons Precluded Qualified Amended Return

The Lamprecht case is a good reminder of how long and complex the path can be for international taxpayers to correct prior wrongs and come into compliance for federal income tax purposes. On April 23, 2024, in Lamprecht v Commissioner, ___ F.4th ___ (D.C. Cir. 4/23/24), ( D.C. Circuit Court opinion) the U.S. Court of…