IRS Provides Updated Voluntary Disclosure Practice Guidance After Closure of OVDP

On November 20, 2018, the IRS issued a memo on “Updated Voluntary Disclosure Practice” (the “Memo”). The Memo sets forth guidance for both domestic and offshore related voluntary disclosures after the recent closure of the Offshore Voluntary Disclosure Program (“OVDP”). The Memo is available here.

Why is this guidance important?

OVDP was the specifically designed for taxpayers with criminal and/or substantial civil penalties due to willful failure to report financial assets and pay the associated taxes on those assets. OVDP was closed to submissions after September 28, 2018. OVDP’s closure left a fair amount of uncertainty on how offshore voluntary disclosures would be processed and resolved.

For individuals that wanted to come forward after September 28, 2018, the IRS website indicated that if a taxpayer had committed a tax or tax-related crime and the taxpayer wanted to remedy the noncompliance, the taxpayer should refer to the Internal Revenue Manual (“IRM”) on voluntary disclosures. See IRM 9.5.11.9 (link). However, the IRM did not provide specific guidance on how offshore disclosures would be processed and what penalties would be asserted.

The Memo provides a framework for how voluntary disclosures, both domestic and offshore, will be processed, worked, and resolved. The Memo also sets forth the policy on how the IRS will assert penalties for voluntary disclosures.

Who are voluntary disclosures for?

“Voluntary disclosure is a long-standing practice of the IRS to provide taxpayers with criminal exposure a means to come into compliance with the law and potentially avoid criminal prosecution. See I.R.M. 9.5.11.9.”[1]

“A voluntary disclosure will not automatically guarantee immunity from prosecution; however, a voluntary disclosure may result in prosecution not being recommended. This practice does not apply to taxpayers with illegal source income.”[2]

In general, the voluntary disclosure process is aimed at bad actors (i.e., those with risk of criminal exposure). This means that it is meant for individuals who acted “willfully” in failing to properly report their income, including foreign bank accounts, and who may have criminal exposure from acting “willfully.”[3]

If an individual did not act “willfully”, then there is less risk of criminal exposure. If these individuals want to correct an error or omission on their returns (or file unfiled returns), then they should weigh the other open avenues to correcting their returns, such as streamline submissions, qualified amended return, and delinquent submissions.

In general, a voluntary disclosure must be made before:

- “the IRS has initiated a civil examination or criminal investigation of the taxpayer, or has notified the taxpayer that it intends to commence such an examination or investigation.”

- “The IRS has received information from a third party (e.g., informant, other governmental agency, or the media) alerting the IRS to the specific taxpayer’s noncompliance.”

- “The IRS has initiated a civil examination or criminal investigation which is directly related to the specific liability of the taxpayer.”

- “The IRS has acquired information directly related to the specific liability of the taxpayer from a criminal enforcement action (e.g., search warrant, grand jury subpoena).”[4]

What is the process for coming forward?

- Provide Information for Preclearance: Individual submits a preclearance request on forthcoming revised Form 14457 to IRS Criminal Investigation (“CI”).

- CI will determine eligibility: CI will use the information on Form 14457 to determine whether the taxpayer is eligible for a voluntary disclosure under the requirements set forth in IRM 9.5.11.9 (i.e., confirm that taxpayer’s disclosure is prior to the IRS commencing an examination/investigation into the taxpayer).[5]

- Taxpayer provides documentation, including a narrative: If taxpayer is precleared by CI, then the taxpayer must promptly submit all required voluntary disclosure documents using forthcoming revised Form 14457. The taxpayer must submit all required returns and reports for the disclosure period. These documents also include a narrative providing “the facts and circumstances, assets, entities, related parties and any professional advisers involved in the noncompliance.”

- CI reviews submission: CI will then determine whether the disclosure should be preliminary accepted.

- Examination: After being preliminary accepted, CI will forward the case file to IRS LB&I Austin for case preparation. LB&I Austin then forwards the file to the appropriate Business Operating Division and Exam function for civil examination.

“All voluntary disclosures handled by examination will follow standard examination procedures. Examiners must develop cases, use appropriate information gathering tools, and determine proper tax liabilities and applicable penalties. Under the voluntary disclosure practice, taxpayers are required to promptly and fully cooperate during civil examinations. In general, the Service expects that voluntary disclosures will be resolved by agreement with full payment of all taxes, interest, and penalties for the disclosure period. In the event a taxpayer fails to cooperate with the civil examination, the examiner may request that CI revoke preliminary acceptance. See I.R.M. 9.5.11.9.4 (discussing cooperation).”

- Resolution: After the examination, the IRS will assess a deficiency, penalties and interest based upon the examination findings. The initial scope of the voluntary disclosure period may be adjusted based upon the IRS’s findings. Taxpayers can argue for application of a lower range of penalties (i.e., accuracy-related (20%) rather than civil fraud (75%)), however “granting requests for the imposition of lesser penalties is expected to be exceptional.”

- Alternative: If the taxpayer is not cooperative, the IRS examiner may request revocation of the preliminary acceptance. At this point, the taxpayer will receive little or no benefit for coming forward through a voluntary disclosure.

What Tax Periods Does a Voluntary Disclosure Cover?

Generally, a voluntary disclosure must cover the lesser of 6 years or the tax years with noncompliance. However, the IRS examiner has the discretion to expand the scope to include the full duration of noncompliance. A taxpayer may, with the IRS’s review and consent, may voluntarily expand the period of disclosure (i.e., to include addition tax years with noncompliance or other issues).

What penalties with the IRS assert?

The IRS will assert the civil fraud penalty for the one tax year with the highest liability in the disclosure period. The civil fraud penalty refers to both the penalty under § 6663 (for any party of any underpayment of tax that was due to fraud)(link) and the civil penalty under § 6651(f)(for fraudulent failure to file) (link).

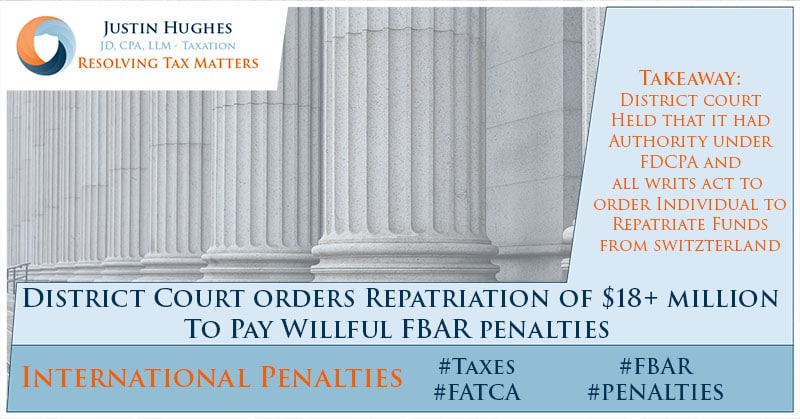

Willful FBAR penalties will be asserted in accordance with existing IRS penalty guidelines under IRM 4.26.16 (link) and 4.26.17 (link).

The Memo notes that penalties for failure to file information returns will not be automatically imposed. It is up to the examiner’s discretion, which “will take into account the application of other penalties (such as civil fraud penalty and willful FBAR penalty) and resolve the examination by agreement.”

The taxpayer retains the right to request an appeal with IRS Office of Appeals. Therefore, if the taxpayer believes that the IRS examiner is not properly applying the Internal Revenue Code, Treasury Regulations, or IRS policies, the taxpayer can have the examiner’s findings reviewed by an independent IRS appeals officer.

Conclusion

The Memo provides some helpful guidance on how voluntary disclosures will be processed by the IRS after the closure of OVDP. The IRS will take some time before updating the Internal Revenue Manual based upon the policies announced in the Memo. The update to the IRM may provide even more guidance and specificity on how voluntary disclosures will be processed and resolved.

Voluntary disclosures are a big step because the taxpayer will likely face substantial tax, penalties, and interest from the correction of the taxpayer’s filings or lack thereof. On the other hand, a taxpayer that has criminal exposure may be able to reduce the risk of criminal prosecution by coming forward before the IRS comes to the taxpayer. If a taxpayer decides to come forward, he must plan on cooperating fully or risk having the voluntary disclosure being rejected, which would potentially nullify the main benefit of coming forward.

Before coming forward, taxpayers should seek to understand if they should make a voluntary disclosure or use one of the other methods to correct prior noncompliance (i.e., streamlined submission, qualified amended returns, delinquent submissions). Generally, only taxpayers that have criminal exposure should utilize a voluntary disclosure.

Notes:

[1] Memo at 1.

[2] IRM 9.5.11.9 (12-02-2009) – Voluntary Disclosure Practice.

[3] See generally IRM 9.1.3.3.2.2.3 (05-15-2008) – 26 USC §7201 – Willfulness– for an a high level overview of “willfulness”.

[4] IRM 9.5.11.9 (12-02-2009) – Voluntary Disclosure Practice.

[5]The current version of the Internal Revenue Manual for voluntary disclosures can be found here. The Internal Revenue Manual will be revised to reflect the changes in the IRS policy per the Memo at some point in the next two years.

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.