Shaffran v. Commissioner: Tax Court Rejects IRS’s “De Facto Officer” Argument in Trust Fund Recovery Penalty Case

The taxpayer in Shaffran v Commissioner, T.C. Memo. 2017-35 (link) was not an owner, officer, or employee of a restaurant that got behind in its federal payroll taxes. Yet, the IRS still attempted to assert the Trust Fund Recovery Penalty (“TFRP”) against the taxpayer under the theory that he was a “de facto officer”.

How does one become a “de facto officer” for purposes of TFRP investigation?

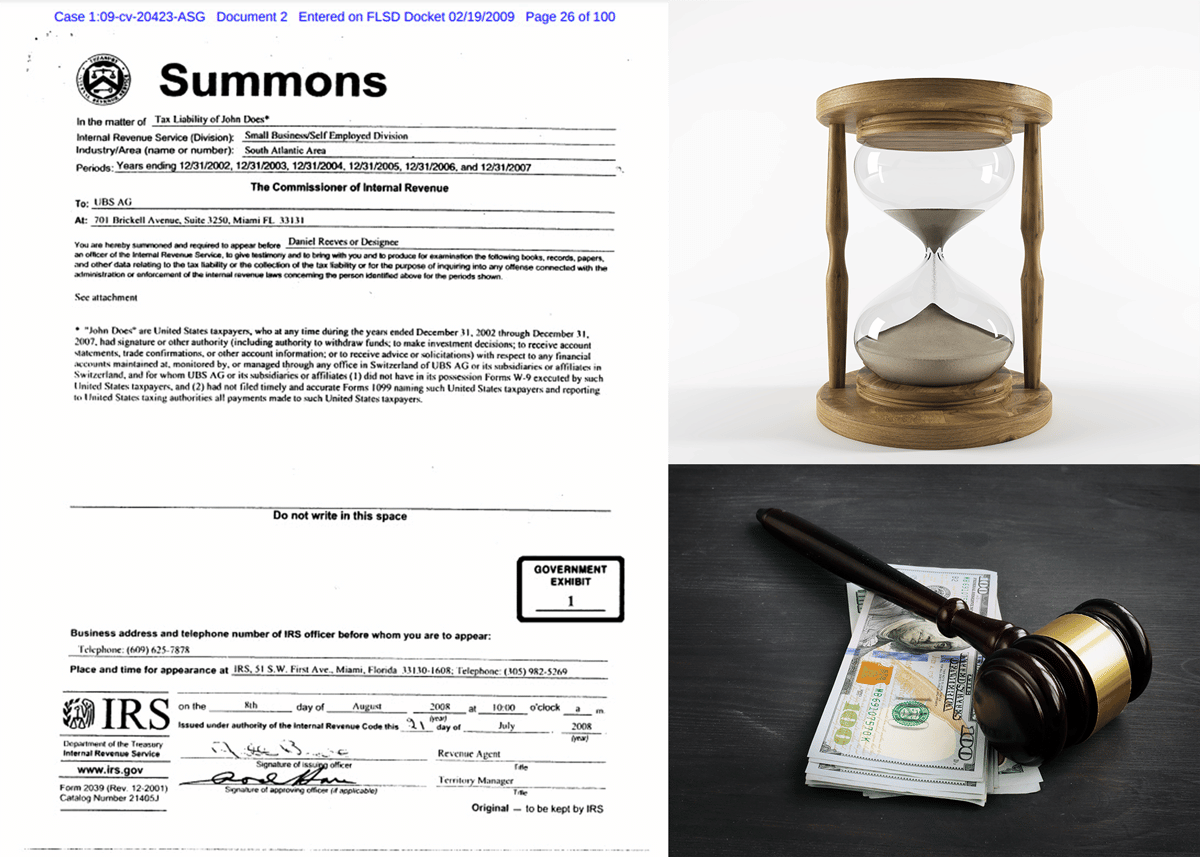

The IRS argued that he became a de factor officer by signing four checks and writing out several others for the business’s manager’s signature. This is despite the fact that the taxpayer did not have check signing authority and he was not an owner, officer, or employee of the business.

Fortunately, the Tax Court rejected this argument and held that the taxpayer was not a responsible party and therefore could not be held liable under the TFRP for the company’s unpaid payroll taxes.

What persuaded the Tax Court?

Based upon the evidence provided at trial, (1) did not have the authority to hire and fire the restaurant’s employees; (2) had no duty to, and did not, review or reconcile the restaurant’s bank statements; and (3) had no control over disbursements and decisions pertaining to the restaurant’s bank accounts, including the payroll account. Also, the petitioner did not have any involvement in the preparation or filing of restaurant’s employment tax returns or the payment of its employment taxes.

Was this a slam dunk win for the taxpayer?

If not a slam dunk, then likely a lay-up. Nevertheless, the Tax Court did appear to take the IRS’s argument regarding check signing seriously.

“To be sure, the exercise of check signing authority is a significant factor in determining whether someone has authority to choose which creditors to pay. In contrast, the preparation of checks for another’s signature does not connote such authority.” Shaffran at 17 (citing See Williams v. United States, 931 F.2d 805, 810 (11th Cir. 1991).)

But, the Tax Court found that signing four checks was not enough. Those checks were less than 1% of the restaurant’s checks issued in the quarter in which they were written. Two of the four checks were only signed after approval by the owner of the restaurant. The other two were only signed when the owner and manager were not around and someone had to take delivery of vendors orders. From these facts, the Tax Court concluded that the “limited check signing activity does not support a finding that petitioner had sufficient control over [the restaurant’s] affairs to avert the nonpayment of its employment taxes”. Shaffran at 17.

Why did the IRS assert that the taxpayer was a responsible person?

The opinion seems to suggest that the revenue officer working the case was in a hurry. The statute of limitations on assessment of the payroll taxes was approaching so the revenue officer sped through a investigation. [1] The IRS does not like letting a statute of limitations lapse on a potential assessment, so, rather than taking the time to get the right answer, the revenue officer assessed anyone that could remotely be considered a responsible party.[2] The opinion indicates that the revenue officer mistakenly believed that more than just four checks were signed by the taxpayer. See Sharffran at 7 and FN 14.

Takeaway: If you sign checks on behalf of a business, even if you are not an owner, officer, or employee of the business, you can be swept up into a trust fund penalty recovery case. Even though the taxpayer did have a strong case, he still had to go through a Tax Court trial to squash the IRS’s proposed TFRP assessment.

If the IRS is investigating your business’s unpaid payroll taxes, then you should contact a professional before submitting to a 4180 interview. Also if you have received a Letter 1153 or know that you have been personally assessed the Trust Fund Recovery Penalty, then please see the Service page Trust Fund Recovery Penalty.

Note

[1] “On a Form 4183, Recommendation re: Trust Fund Recovery Penalty Assessment, prepared concurrently with the Letter 1153, RO Kane wrote: “DUE TO THE SHORT STATUTE AND RECENT RECEIPT OF THE CASE FILE, CANNOT FULLY DOCUMENT WILLFULNESS [of petitioner] AT THIS JUNCTURE.” Shaffran at FN 8.

[2] In addition to the taxpayer, the revenue officer recommended assessment of five individuals, including the taxpayer. Two of the individuals were managing members that did not sign checks. The revenue officer withdrew recommendation against these individuals. As mentioned above, the opinion indicates that the revenue officer mistakenly believe that the taxpayer had signed checks routinely because she confused the taxpayer’s signature with another’s signature.

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.