IRS Memo Requires Use of FATCA Data in Certain Collection Cases

On August 16, 2021, the IRS Director of Collection Policy issued a memorandum to provide guidance when FATCA[1] information should be used in IRS Collections cases. See SBSE-05-0821-0015 (the “Memo”) (available at the IRS website here: link). The new guidance from the Memo will be added to the Internal Revenue Manual effective August 16, 2021.

The Memo provides that, when certain criteria are met, Collections personnel are required to access available FATCA data as they would any other income or locator source (e.g., consumer credit report, real property records, etc.) for potential collection. [2] If the criteria are not met, then Collection personnel are not required to but have the discretion to utilize FATCA data.

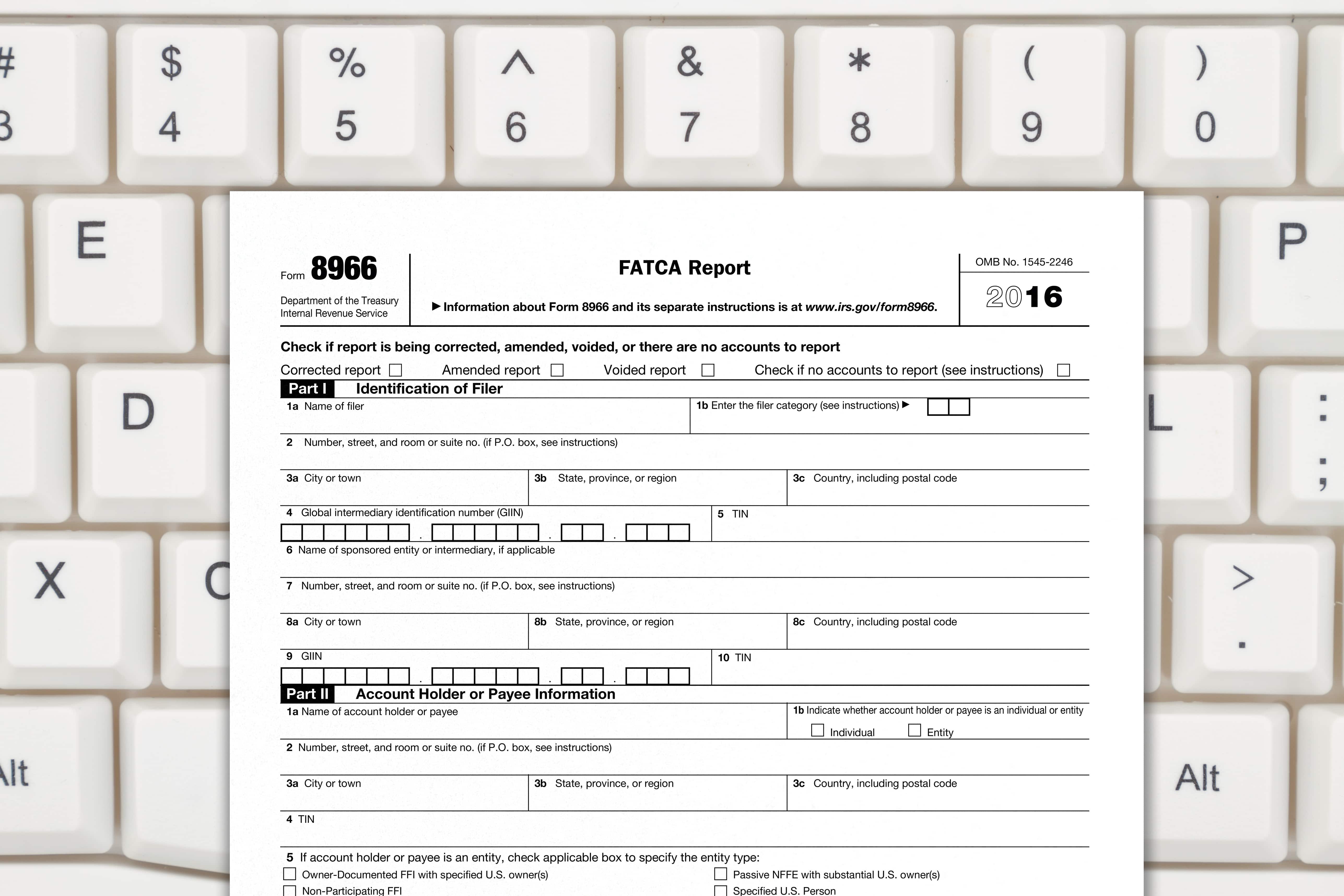

FATCA data should be analyzed when received and documented in the ICS history. Any discrepancies between the information reported on Form 433-A/B and the FATCA data report should be investigated by the employee. The Form 8966 provides the Revenue Officer with the name, address and TIN of the entity and taxpayer. It provides the type of account and the account balance. The data found on the FATCA report can be used to make a collection determination and addressed with the taxpayer or their representative to come to an agreeable resolution, if possible. If an agreed resolution cannot be met, the FATCA data can be utilized in support of enforced collection actions, as basis to reject pending installment agreements, and proposed offers in comprise (OIC’s). More information can be found in IRM 5.8.1, 5.10.1, 5.11.1 and 5.14.9.7.

The new guidance highlights that the data will be used in High-Income Non-Filer cases where the unreported income exceeds a certain dollar threshold, which is redacted from the version of the Memo shared with the public.

IRM 5.1.11.2.3.1(4), Delinquent Return Investigations – In IMF High Income Non- Filer (HINF) delinquent return investigations with unreported income in a single tax year exceeding # [redacted] #, data should be used from Form 8938, Statement of Specified Foreign Financial Assets, and — unless treaty disclosure rules prohibit use — Form 8966, FATCA Report. Refer to proposed IRM 5.1.18.21, FATCA Research, for procedures to research Form 8938, Statement of Specified Foreign Financial Assets, and to request Form 8966 FATCA Report.

The Memo provides guidance on when FATCA data should be used in offer in compromises (OICs), bankruptcy cases, partial pay installment agreement requests, potential currently not collectible determinations, and several other contexts.

Since FATCA has been in place for a number of years now, it is not surprising that the IRS is formalizing its procedures on how to utilize the information on the frontlines.

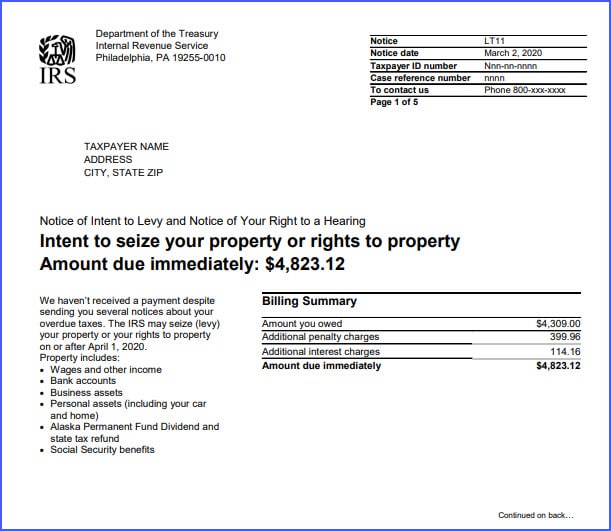

Taxpayers should be cautious that in recent years IRS Collections has been quicker to refer cases to IRS Criminal Investigations for failure to disclose income and assets on collection information statements (i.e., Form 433). Taxpayers and their tax advisers should be aware that discrepancies between Form 433 and FATCA information will likely lead to a deeper line of inquiry by the IRS Collections employee. If there is not an adequate explanation for an omission of a material asset or income source, then the Taxpayer risks a referral to IRS Criminal Investigation.

Notes:

[1] Summary of FATCA from the Memo:

The Foreign Account Tax Compliance Act (FATCA) requires U.S. taxpayers to report certain interests in foreign financial assets on Form 8938, Statement of Specified Foreign Financial Assets as an attachment to their Form 1040.

FATCA also requires foreign financial institutions (FFIs) and certain non-financial foreign entities to report interest in non-U.S. financial accounts or assets held by U.S. account holders on Form 8966, FATCA Report. Information contained in Form 8966 may be subject to IRC 6105, Confidentiality of information arising under treaty obligations. In some instances, treaty restrictions may limit or prohibit the IRS from using the information contained in the Form 8966, FATCA report.

FBAR data has been listed as a source for Collections personnel since 2018. See IRM 5.1.18.17 (08-31-2018) Foreign Bank and Financial Account Report (link). However, FBARs only contain data self-reported by taxpayers. Whereas FATCA data is collected by 3rd party institutions, including foreign financial institutions (e.g., foreign banks).

[2] The IRS Collections process for collecting data and sources to be included in searching for income and assets is listed at IRM 5.1.18 Locating Taxpayers and their Assets (link). Sources include consumer credit reports, real property records, DMV, suspicious activity reports, etc. In July 2019, the IRS added cryptocurrency as an item of other income or locator source. See 5.1.18.20 (07-17-2019) Virtual Currency (link).

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.