Requirements For NOL Carryforward Utilization Surviving Scrutiny in IRS Examination

Joe and Mary operate a closely held business that generates a net operating loss in 2005 and 2007. The net operating loss from 2005 and 2007 are carried forward and are used to offset business income on Joe and Mary’s 2015 tax return. Joe and Mary’s 2015 tax return is selected by the IRS for examination. The first IRS information document request (“IDR”) includes a request for a copy of the 2005 and 2007 tax return, along with substantiation for the 2005 and 2007 loses. Do Joe and Mary have to comply with this request?

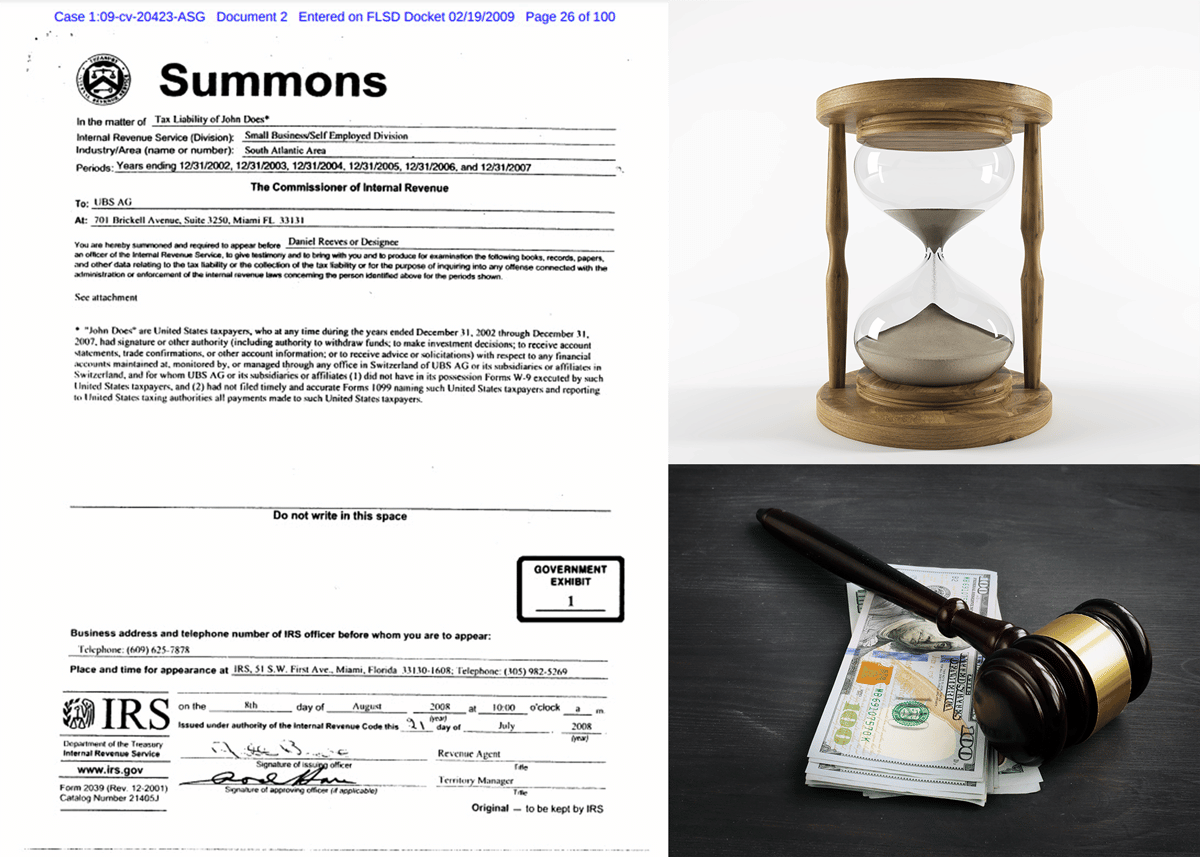

General Statute of Limitations

Generally, the statute of limitations for a tax return is three years from the date of filing the return or the date the tax return is due, whichever is later. See IRC § 6501. And, in some instances, the statute of limitations is open for six years (i.e., gross omission). Most people also recognize that fraudulent tax returns are open indefinitely. Therefore, many tax advisors will indicate that taxpayers should preserve supporting documentation for three to seven years. Even the IRS website indicates that you should keep records for somewhere between 3 and 7 years. (Link)

But, many taxpayers (and some tax return preparers) do not recognize that a return generating a net operating loss can be subject to review for many years past the general three year statute of limitations. While the IRS will not proactively look to audit the NOL year, it will seek to audit the NOL if the year in which the NOL is used is under exam.

NOLs and Substantiation in An IRS Examination

Substantiation of the net operating loss deduction must satisfy IRC § 6001. IRS can look at records as far back as is necessary in order to determine the correct amount of the NOL deduction being utilized in the current year and subsequent years. Copies of the tax returns for the loss year are not proof of the loss and an accountants’ workpapers are inadequate as well.

In Owens v. Commissioner, T.C. Memo 2001-143 (link), the Court concluded that “[a]lthough each of the returns for 1990, 1991, and 1992 shows a loss attributable to petitioners’ Schedule C business, petitioners failed to introduce any evidence establishing the loss claimed in each of those returns. The returns for 1990 through 1992 constitute nothing more than the position of petitioners that they had the respective losses claimed in those returns.” And, in Gould v. Commissioner, 139 T.C. 418, 444 (2012) (link), the Tax Court held that prior year returns and self-serving testimony, absent corroborating evidence, do not substantiate a taxpayer’s entitlement to loss carryovers), aff’d, 552 Fed. Appx. 250 (4th Cir. 2014). And, in Wilkinson v. Commissioner, 71 T.C. 633 (1979) (link), the Tax Court held that a tax return does not establish that a taxpayer had income and losses in the amounts reported on the return. See also, I.R.M. 4.11.11.13 (02-13-2014) Carryforwards (link).

The entire return for the NOL year is open to review to ensure that the NOL carryforward is correct. For example, if the taxpayer has a large related party transaction that generated a significant loss, then the IRS may inquire further into the transaction. This would include, but would not be limited to, the documents surrounding the transaction, technical analysis of loss, basis in the asset giving rise to the loss, and calculation of the loss. If the loss is not adequately substantiated, the IRS agent may deny the loss and thereby reducing or eliminating the NOL. (Note that if the year is closed, if the adjustment would have given rise to taxable income, the IRS will only be allowed to eliminate the NOL carryforward.)

What are Joe and Mary to do?

In the case of Joe and Mary, if the tax year in which the carryover is utilized (i.e., 2015) is still open (i.e., the statute of limitations has not closed on tax year 2015), then the burden is on the taxpayer to prove the loss. Joe and Mary should provide copies of the original tax returns along with all documentation to support the loss (i.e., financial statements, bank statements, invoices, receipts, etc.).

In an IRS exam, this comes up a shock to many taxpayers. Many taxpayers have hard enough time putting together documentation for losses from recent years. And often times, it is extremely difficult for them to put together documentation for losses from tax returns that can be upwards of 20 years old.

What about intervening years?

Not only is the validity of the underlying NOL subject to review, the NOL carryforward itself can be analyzed to determine if it should have been absorbed in prior years. For example, in Joe and Mary’s case, they IRS can review whether or not the NOL carryforward from 2005 and 2007 should have been utilized or partially utilized in 2008 through 2014. Also, if the taxpayer could have carried the NOL back two years and did not waive the carryback, then the IRS could look in 2003 and 2004. As a result, the analysis of whether a NOL carryforward can be utilized in a current year requires a significant amount of substantiation and analysis to withstand scrutiny in an IRS examination.

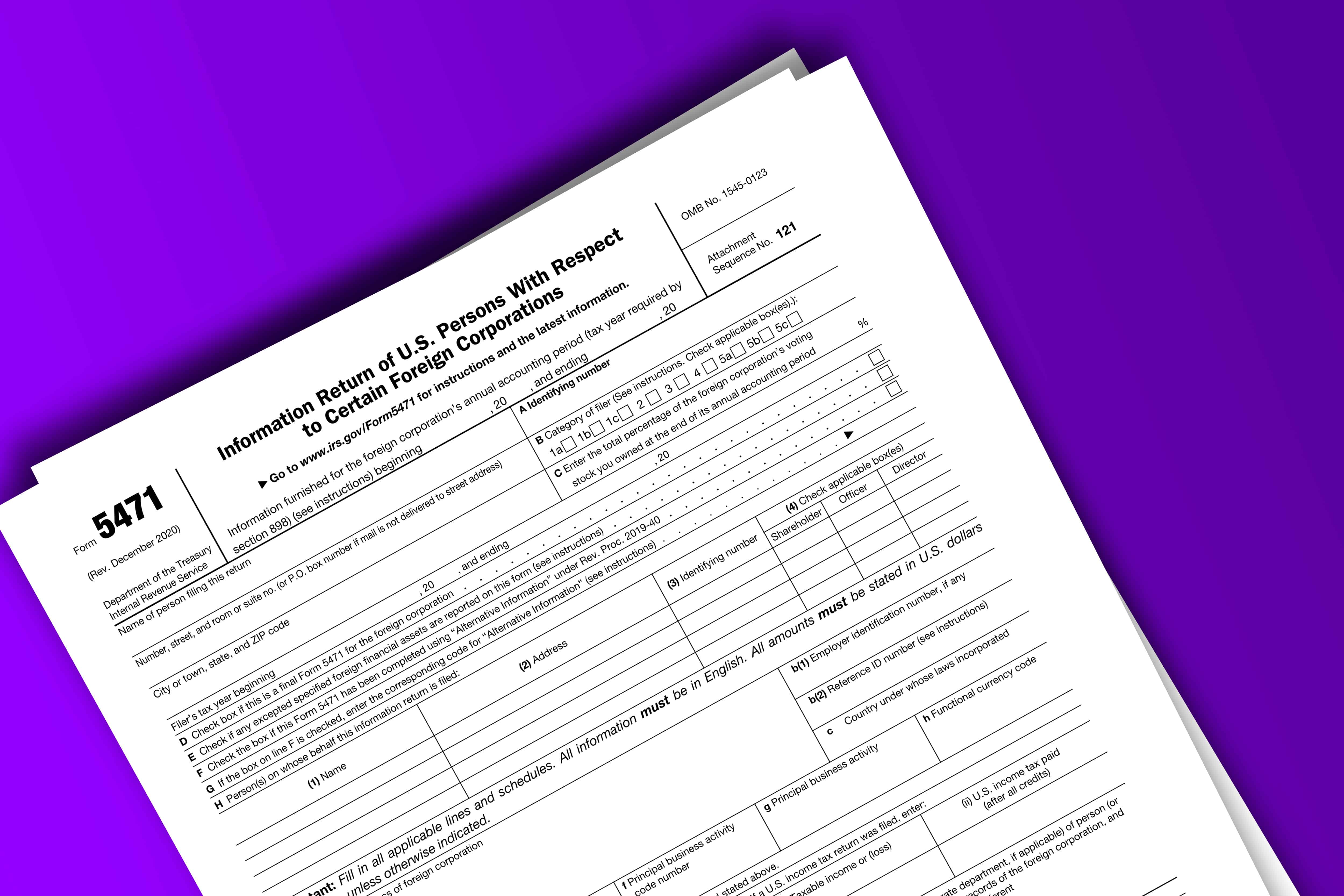

What happens if the Losses are From K-1’s?

This issue came up in a recent Tax Court case involving a closely held S corporation. In Enis v. Commissioner, T.C. Memo. 2017-222 (link), the taxpayer utilized approximately $2.5 million of NOL carryforwards on his 2010. The NOLs were originally stemmed from over 20 schedule K-1’s from several investments over tax years 2005 through 2014. Although the taxpayers provided copies of most of the Schedule K-1s, Schedule K-1s are insufficient on their own. They are merely a starting point, not proof of the loss. Therefore, the Tax Court upheld the IRS’s denial of NOL carryforward utilization on the taxpayer’s 2010 tax return.

Additional Hurdles

Assuming that the taxpayer can substantiate the amount of the NOL, the taxpayer must generally also show that he had sufficient basis in the invest (i.e., basis in partnership interest or S corporation stock) and that there were no other limitations that would limit the realization of the NOL (i.e., at-risk and passive activity limitations).

Denied NOL Deductions Can Lead to Accuracy Related Penalties

As always when adjustments are made in an IRS examination, if an NOL carryforward deduction is denied for lack of substantiation, then the taxpayer may be subject to the 20% accuracy related penalty on the underpayment of tax associated with the denial of the NOL carryforward deduction.

Conclusion

Claiming a NOL carryforward on a tax return is relatively simple. However, if the tax return including the NOL carryforward utilization is chosen for an IRS examination, then the taxpayer must carefully prepare to substantiate the NOL carryforward and prove the availability of the NOL carryforward. Therefore, underlying documents to substantiate the items on the tax return generating the NOL should be keep until the NOL carryforward is utilized and that tax year is closed (i.e., beyond the applicable statute of limitations). And, the taxpayer should also keep any documentation or workpapers to prove that the NOL carryforward is otherwise available and not subject to limitation.

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.