Tax Court Rejects Taxpayer’s Reasonable Cause Argument Regarding Automatic Penalties from Failure to File Forms 5471

Flume v. Commissioner (here) revolved around one noteworthy issue: did the taxpayer’s reliance on the advice of his tax return preparer spare the taxpayer from $110,000 in penalties for the taxpayer’s failure to report foreign investments on Form 5471? The taxpayer argued that he relied on the expertise of his tax return preparer to guide him to prepare the necessary forms. The IRS argued that the taxpayer could not escape penalties because the taxpayer failed to advise the tax return preparer of his foreign investments.

Brief Summary of Facts

The taxpayer is a U.S. expat living in Mexico and owned a majority interest in a Belizean corporation and a Mexican corporation.[1] From 2001 to 2008 the taxpayer did not tell his tax return preparer about these investments.[2] The taxpayer timely filed his Form 1040, but he did not report the foreign investments to the IRS on Form 5471.

In 2012, the IRS began an examination of the ownership and control of the foreign investments. At this point, the taxpayer engaged a professional to represent him in the audit and he also filed delinquent Forms 5471.[3]

As a result of the exam, the IRS assessed penalties against petitioner under sections 6038 and 6679 totaling $20,000 for 2001, $20,000 for 2002, and $10,000 for each year from tax years 2003 through 2009 for failure to file Forms 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations. The penalties stemmed from the taxpayer’s failure to report his ownership interest in the foreign corporations.

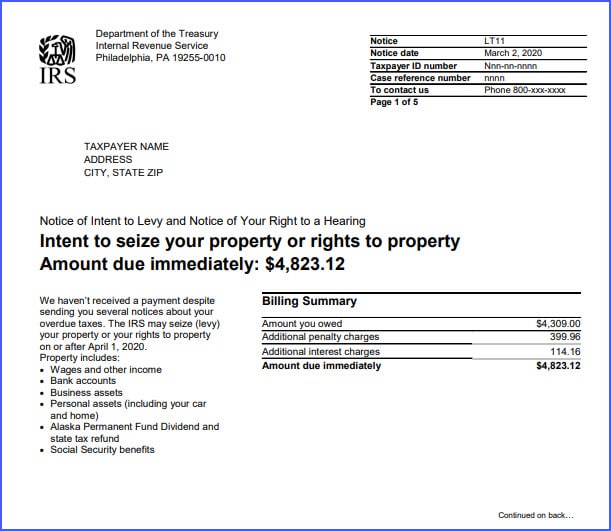

The taxpayer was eventually hit with a notice of intent to levy for the tax penalties. The taxpayer requested a CDP hearing by filling out Form 12153 – Request for CDP. During the hearing, the Settlement Officer upheld the levy and the taxpayer appealed to the U.S. Tax Court.

Reasonable Cause To Avoid Penalties

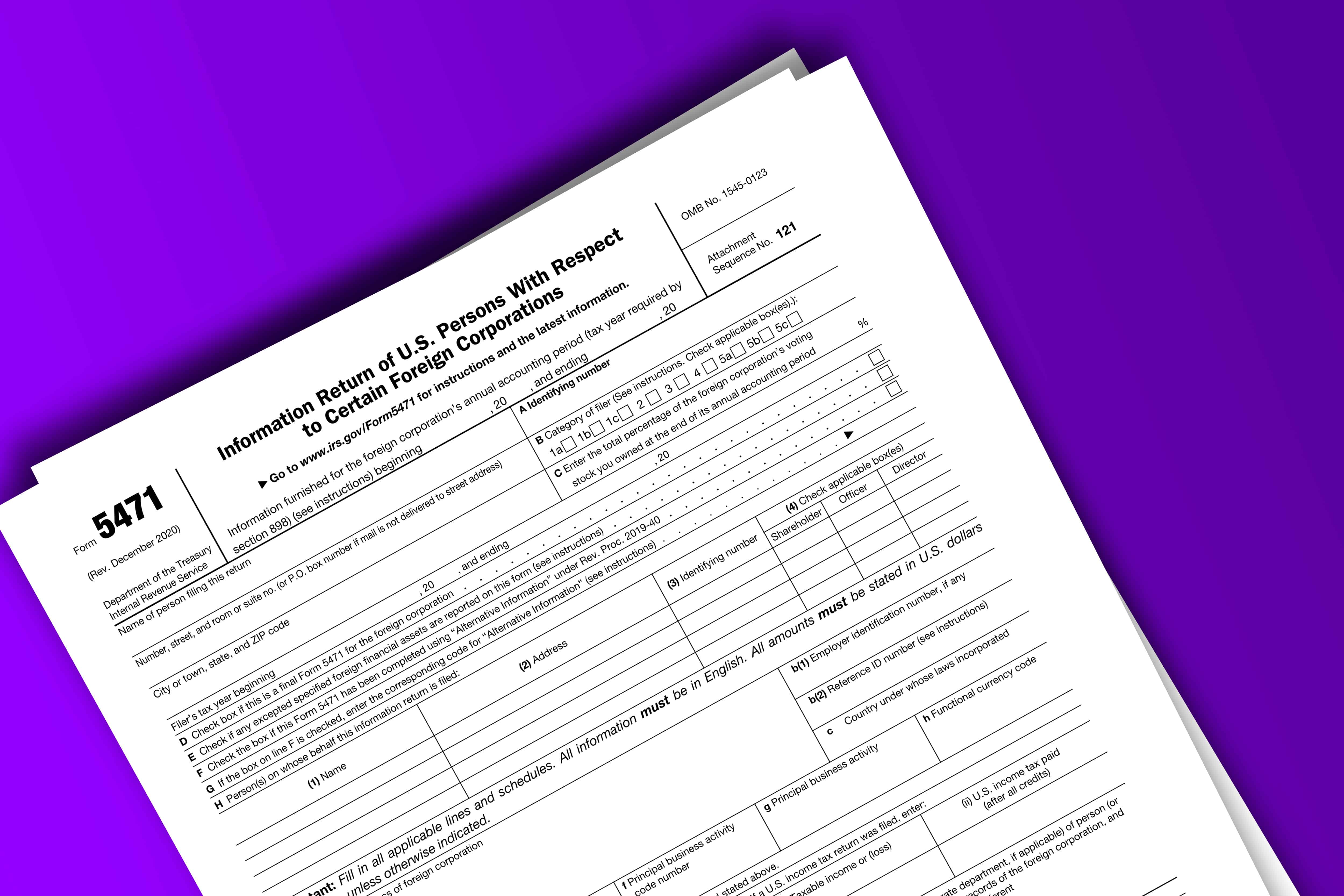

In recent years, the IRS has become more aggressive in enforcing international financial interest reporting regulations. Failure to comply with such regulations carries steep penalties. For example, failing to file Form 5471 – Information Return of U.S. Persons With Respect to Certain Foreign Corporations carries a $10,000 penalty.

In addition, failure to file a Form 5471 with a return can cause the general statute of limitations of the taxpayer’s income tax return to be extended until three years after the Form 5471 is filed.[4]

Usually Form 5471 is filed along with Form 1120. According to an internal IRS memo, there should be consistency in applying the penalty if a taxpayer failed to file both its Form 1120 and the Form 5471. See CCA 200748006 (link). And, if Form 1120 was timely filed (i.e., “reasonable cause” was irrelevant to Form 1120), then “reasonable cause” with respect to failing to file Form 5471 can still be found independent of reasonable cause from failing to file Form 1120. See CCA 200748006 (here).

Overview of obligation to file Form 5471

- Who? This is complex, so resort to Form 5471’s instructions and/or consult a tax professional. However, any “U.S. Person” that is a shareholder, officer, or director of a foreign corporation that has a significant U.S. shareholder (i.e., U.S. Person owning 10% or more by voting power or value) should closely examine if they have a Form 5471 filing obligation. Generally, a U.S. person in this context is either a (i) U.S. citizen; (ii) U.S. resident; (iii) domestic partnership, domestic corporation, and non-foreign estate or trust; or (iv) non-resident alien that elected to be treated as a U.S. resident.

- What? Depending on category of the filer, Form 5471 and related schedules require information relating to the corporation’s income/loss, balance sheet, and ownership information.

- When? Due date (including extensions) for taxpayer’s income tax return.

- See IRS website for Form 5471 & Instructions here.

Penalties for failing to file Form 5471

- $10,000 for each annual accounting period of each corporation;

- “Solicitation penalties” – additional $10,000 for each 30-day period (or fraction thereof) beginning 90 days after the IRS notice of failure to file required information. Capped at $50,000.

- Reduction of 10% of foreign taxes available for foreign tax credit (§§ 901, 902, 960).

- Criminal penalties are also possible.

- Tolling of the statute of limitations on the taxpayer’s income tax return.

Federal tax law generally provides that taxpayers can avoid many penalties if they have “reasonable cause” for failing to meet certain duties.[5] Specifically, for purposes of Form 5471, to avoid the $10,000 penalty, a taxpayer must “make an affirmative showing that the failure to furnish the appropriate information with his return was due to reasonable cause”.[6] When a taxpayer affirmatively shows reasonable cause, the time for filing the information return is extended, but it does not absolve the taxpayer from filing Form 5471.

As the court noted in Flume, there are no definitions of “reasonable cause” in the code section and related regulations that establish the information reporting requirements on Form 5471. Similar “reasonable cause” analyses have been prescribed by related information reporting sections, so the Tax Court leaned on case law interpreting “reasonable cause” in those contexts. Specifically, the Tax Court looked to an often-cited case, Neonatology Associates, PA, for the general elements that a taxpayer must affirmatively show to establish “reasonable cause.”

Reliance on Tax Advisor As Grounds for Reasonable Cause

Many taxpayers use reliance on their tax return preparer as an excuse to attempt to avoid penalties, specifically it often comes up in attempts to defend against accuracy related penalties.[7] However, actual reliance on the tax return preparer is not enough. The reliance must be “reasonable”. ‘‘[B]lind reliance on a professional does not establish reasonable cause.’’[8]

“To establish reasonable cause through reliance on a tax adviser’s advice, the taxpayer must prove: (i) the adviser was a competent professional with sufficient expertise, (ii) the taxpayer provided necessary and accurate information to the adviser, and (iii) the taxpayer relied in good faith on the adviser’s judgment. Neonatology Assocs., P.A. v. Commissioner, 115 T.C. 43, 98-99 (2000 (here), aff’d, 299 F.3d 221 (3d Cir. 2002)(here).

In Flume, the taxpayer asserted that the penalties are inapplicable because he had relied on his tax return preparer’s advice and therefore had “reasonable cause” for his delay in filing Form 5471. [9] And, the taxpayer argued that he ultimately filed the Forms 5471 once he became aware of the obligation, so he therefore met his obligation to file Forms 5471.

However, the taxpayer in Flume failed one element of the “reasonable cause” standard. So, what did the taxpayer do that was unreasonable in the eyes of the Tax Court?

Reasonable Cause & 2nd Prong of Neonatology

The second prong of the Neonatology analysis requires that the taxpayer must have provided “necessary and accurate information to the adviser.” Thus, there can only be “reasonable cause” if the taxpayer provides the tax return preparer with enough information to give advice. However, the second prong generally only requires the taxpayer to provide what the taxpayer knows or should have known.[10]

The Flume opinion makes it clear that the taxpayer did not discuss the investments with his tax return preparer until 2008. However, the opinion did not provide any indication about whether the tax return preparer asked the taxpayer about his investments or if the preparer warned the taxpayer about the special informational reporting requirements for foreign investments. There was no indication whether this was a simple oversight on the part of the taxpayer. The opinion made no mention of income from the investments during the relevant tax periods and whether such income was properly reported.

Based upon this standard, the taxpayer in Flume should have at least advised his tax return preparer that he owned the investments. The taxpayer would have needed to provide evidence that he discussed or provided information to his tax return preparer. Without such showing, the taxpayer could not establish that he tax return preparer had enough information to provide advise with respect to the taxpayer’s information filing obligations.

Conclusion:

It is understandable that taxpayers rely on tax return preparers and tax advisers to help them navigate the maze of federal international tax reporting obligations. But if you do not provide the professional with all the facts related to your financial holdings, you should not expect that you have “relied” on the tax return preparer such that you can avoid penalties stemming from the omitted facts.

Notes:

[1] The taxpayer owned 50% of the Mexican corporation in 2001 and 2002. He sold a portion of his interest in 2002, which reduced his interest to 9% in 2002. The taxpayer and his wife owned 50% of the Belizean corporation. The taxpayer and his wife attempted to give retroactive effect to gifts to their children, but the Tax Court held that the retroactive gifts were ineffective.

[2] Flume v. Commissioner, T.C. Memo 2017-21, 5.

[3] The taxpayer ended up submitting revised Forms 5471, but it is not apparent that this was important to the court’s decision or the analysis. The opinion did note that both the original and revised Forms 5471 were “incomplete”, but the opinion did not discuss what information was omitted.

[4] Section 6501(c)(8) (here). This code provision was enacted as part of The Hiring Incentives to Restore Employment (HIRE) Act of 2010 (Pub.L. 111–147).

[5] See generally section 6664(c) & (d). See also Internal Revenue Manual 20.1.1.3.2 (11-25-2011) Reasonable Cause (here) for the IRS’s general view on “reasonable cause”.

[6] Section 6038(c)(4)(B). Note that the test requires that the taxpayer must affirmatively provide a basis for reasonable cause. Therefore, if the IRS assessed the penalties, the taxpayer must come forward with some proof that he has reasonable cause because he relied on the tax return preparer.

[7] Accuracy-related penalties are the most litigated issue in Tax Court again for 2016. See Taxpayer Advocate’s Report for 2016, page 428 (here). However, a taxpayer can avoid accuracy related penalties if the taxpayer can show “reasonable cause.” See IRC 6664(c).

[8] See Estate of Goldman v. Commissioner, T.C. Memo. 1996–29, 71 T.C.M. (CCH) 1896, 1903 (1996) (here).

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.