Bacon v. Commissioner: Beware, Forms 1099-C Are Not Always Accurate

Overview

The Tax Court determined that the extinguishment of the taxpayer’s debt took place in a closed tax year, even though FEMA issued a 1099-C[1] in an open tax year. As a result, the Tax Court held that the IRS was barred by the statute of limitations from assessing the taxpayer for the federal income tax on cancellation of indebtedness income (“COD income”).

Takeaway

Determining the timing and amount, if any, of COD income can be a very complex analysis.[2] Institutions, including banks and federal agencies, issuing Form 1099-C do not always get the analysis right. As a result, if you receive a Form 1099-C, you should have a discussion with your tax adviser to make sure that the amount and timing of the COD is accurate. In addition, even if the amount and the timing are correct, there are provisions that may allow a taxpayer to exclude the amount from gross income.

Facts

The taxpayer in Bacon v. Commissioner, T.C. Summary Opinion 2015-15 (March 2, 2015), made a claim for and received FEMA disaster assistance funds to help repair his property damaged by an earthquake in January 1994. However, in October 1994, after disbursing the funds, FEMA determined that the taxpayer was not qualified to receive the funds.

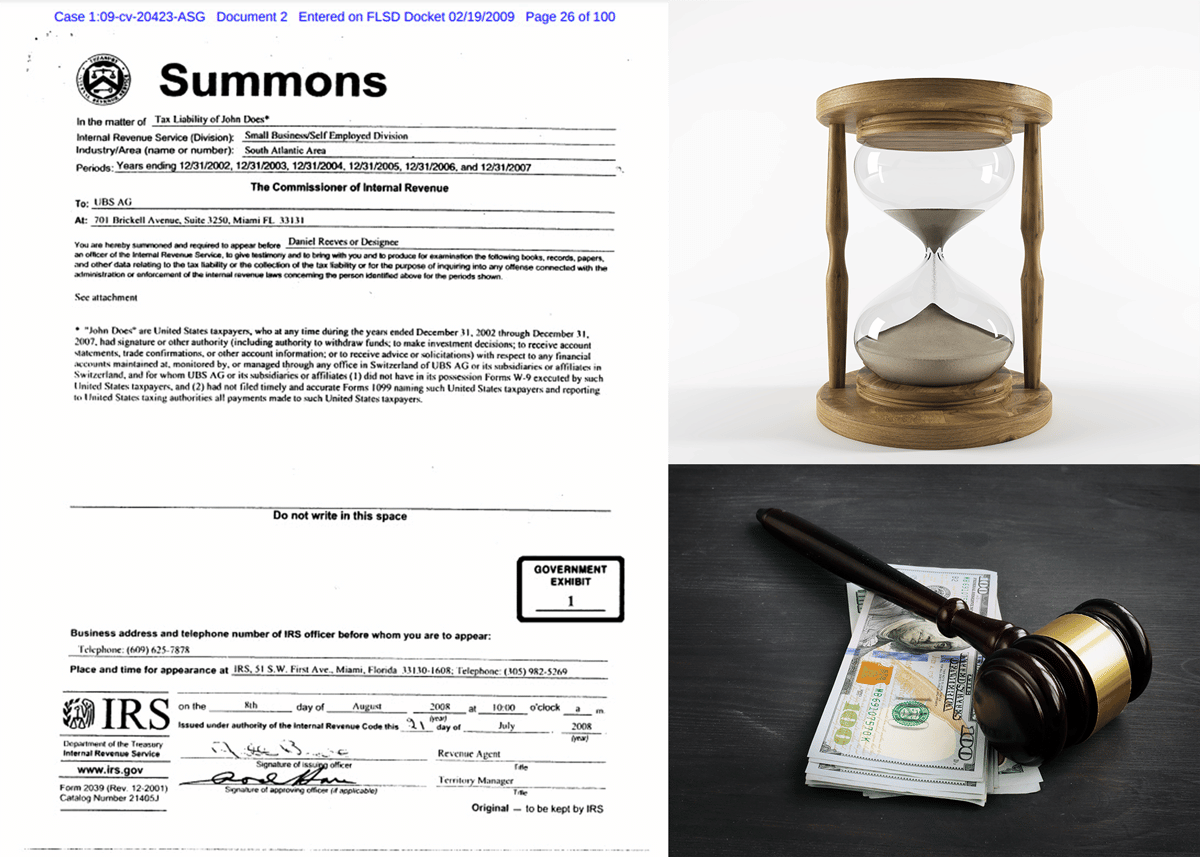

For several years FEMA attempted to recoup the funds, but the agency was unsuccessful. In 1997, FEMA handed the collection effort over to the DOJ for judicial enforcement, but the DOJ never commenced a suit or initiated any action.

Pursuant to the underlying federal statute regarding the disaster funds, the statute of limitations for bring a suit lapsed in 2001. In February 2008, after 10 years of inactivity, FEMA mailed petitioner a Form 1099-C, Cancellation of Debt, reporting discharge of indebtedness for an amount representing the principal amount initially distributed plus the interest and penalties.

Petitioner did not report any COD income on her timely filed Federal income tax return for 2007

After audit, the IRS issued the taxpayer a notice of deficiency,

Analysis

1099-C’s are Not Conclusive

Receipt of a Form 1099-C is evidence of COD income, but it is not conclusive. It is important to have an informed discussion with your tax advisor regarding the facts surrounding the origination and discharge of the debt to determine if the Form 1099-C is correct. In addition, such amounts may be excludible from income. Again, discussions with your tax advisor is key to making sure that you do not miss an opportunity.

Running of a Statute of Limitations May or May not Extinguish a Debt

For purposes of determining COD, the expiration of a statute of limitations on the collection of debt is not equivalent to the expiration of a statute for bringing a claim in court. Generally, the running of a statute of limitations does not extinguish the underlying debt.[3] Rather, the expiration merely provides the debtor an affirmative defense to an action by the creditor.

On the other hand, if a statutory period for bringing a claim expires, then there is an extinguishment of the debt because the right to payment cannot be reduced to a deficiency judgment. In other words, the statutory claim for payment cannot be transformed into a legally recognized right to payment.

Tax Court’s Holding

In Bacon, the Tax Court held that the taxpayer realized COD income in 2001, when the statute of limitations ran out on FEMAs ability to bring a suit to force repayment. As a result, the Tax Court held that the Form 1099-C issued by FEMA was erroneous. And, since the IRS did not seek to assess tax on this income until 2009, the IRS was barred from assessing the taxpayer for her underpayment relating to the COD income.

Notes:

[1] Form 1099-C; Instructions to Form 1099-C; Pub

[2] See IRS Pub. 4681.

[3] Miller Trust v. Commissioner, 76 T.C. 191 (1981).

Justin Hughes, JD, CPA, LL.M.

Justin Hughes focuses on resolving federal and state tax disputes for individuals and businesses. He has represented clients before the IRS and state taxing authorities at all stages, including audits, administrative appeals, litigation, and collections. As both an attorney and a CPA, he combines legal insight with accounting experience to help resolve tax problems for clients.